With recent devastating disasters, fires, and flooding across the country, insurance companies are changing their regional homeowners insurance qualifications based on risk factors.

In the northern New Mexico region, the fire season has expanded to be year-round. We have a dry, arid environment, coupled with persisting drought, unpredictable monsoon rainfall, and dry, fine fuels in our forested areas—this is a direct result of climate change. Historically, peak fire season begins in early May and runs from June, until monsoon season in July.

In 2022, northern New Mexico saw the largest and most destructive fire in its history, burning 341,471 acres between early April and late June in San Miguel, Mora, and Taos counties. 2022 is also recorded as the most significant and record-breaking fire season, causing several hundred homes and structures to burn.

Still recovering economically and emotionally, many residents in northern New Mexico counties and other areas across the country are now finding themselves being denied homeowners insurance, based upon the regions in which they reside.

In early December, the Senate Budget committee on Capitol Hill presented a report entitled The Climate-Driven Insurance Crisis is here, and Getting Worse.

The report detailed the economic cost of climate change and how it could potentially destabilize and pose a threat to the U.S. economy and global financial systems. Item 4-B on the agenda outlined how homeowners insurance markets and property values were chief economic threats.

It goes on to note that some insurers are unable to justify doing business in communities on the front lines of climate change and have pulled out of markets entirely. They cite “‘rapidly growing catastrophe exposure, and a challenging reinsurance market.” Additionally, it states “major companies have stopped writing new policies in particularly high-risk regions.”

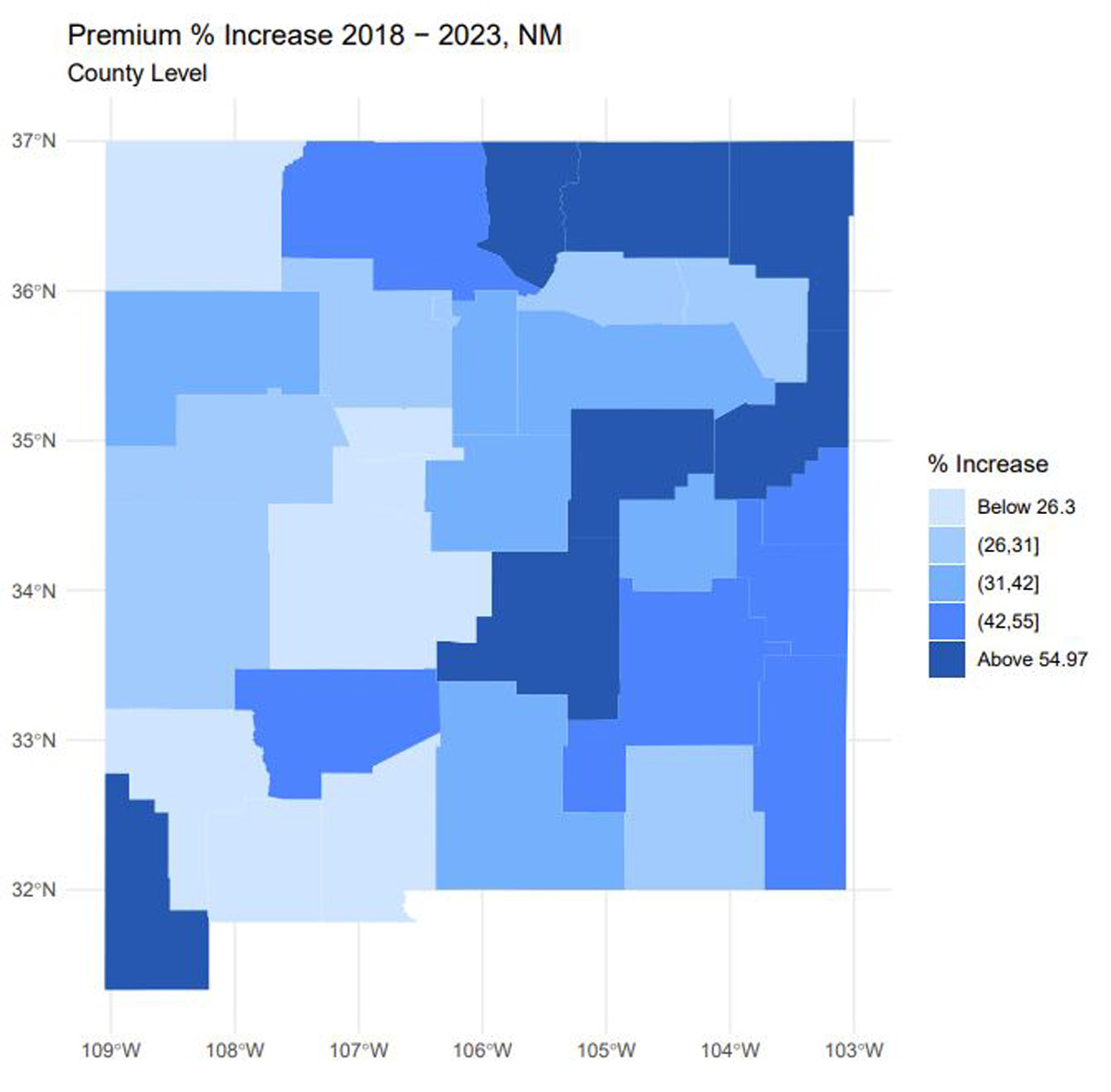

According to data from 2023, New Mexico sits at #11 for non-renewals of homeowner insurance policies due to increased fire risk of the state. Additionally, over 54 percent of residents saw a premium increase in 2023.

The report says that while counties may not yet be considered at significant climate risk, they are beginning to experience significant insurance non-renewal risk, likely because insurance availability is at risk in proximate counties.

The report notes that as climate change gets worse, so does trouble in insurance markets, threatening mortgage markets and property values. In certain communities, high insurance premiums and unavailable coverage will make it nearly impossible for anyone who cannot buy a house in cash to get a mortgage and buy a home.

This data is valuable to help New Mexicans prepare their homes and properties, making them fire-resistant and safe. Some tips include:

- Remove all trees and large shrubs within 30 feet of the home.

- To a distance of 100 feet (200 feet on steep lots), remove some trees and shrubs to create 10 feet of space between adjoining trees’ outermost branches. Prune lower branches of remaining trees up to 10 feet off the ground.

- Remove ladder fuels, young trees, and shrubs planted close to larger trees that could carry a surface fire into the tops of large trees.

- Minimize flammable debris. Keep roofs and rain gutters free of pine needles, leaves, and other flammable material.

- Keep firewood and other flammable debris a minimum of 50 feet from the house, preferably on the uphill side.

- Mow grasses to a height of less than 6 inches within 50 feet of the home.

- Use fire-resistant construction and landscaping. Wood shake shingle roofs are highly flammable. Convert roof to Class A fire-resistant materials such as fiberglass-asphalt, metal, and tile.

- Construct decks and siding with non-combustible materials.

- Screen openings under decks and attic and foundation vents.

- Check with local nurseries to learn about fire-resistant landscaping.

- Call your local forestry office for more information.