The Questa Credit Union (QCU) was founded in June of 1959. If you’re a member, you are also part owner. That’s what makes credit unions different; they are member-owned and operated.

Initially beginning its operations out of the home of its first manager, Nick Ortega, the QCU continues to pride itself on its mission statement, “Questa Credit Union makes it easy to realize your financial potential and creates thriving communities,” and guiding philosophy “People helping people.”

Unlike banks, credit unions operate as not-for-profit organizations whose goals are member-focused. Members have a say in how the credit union is operated and updated. Members gather yearly.

The annual meeting for the QCU takes place in Questa, usually in February. This year 98 of 2,100 members attended. Food was provided, there was live music, prizes were handed out, and one member won $500. “We want as many members there as possible to learn about the QCU and how it works,” says Manager Katherine Flory, who started at the Questa Credit Union in 2006 as a clerk/teller. She has been manager since 2019.

“There are some people who don’t realize that the members are the reason why we are here. We want to hear the needs of members,” says Chief Loan Officer and Assistant Manager Patricia Garcia. Flory and Garcia cite a member’s suggestion from a past annual meeting to have safety deposit boxes. Soon after, several boxes were ordered and offered for members.

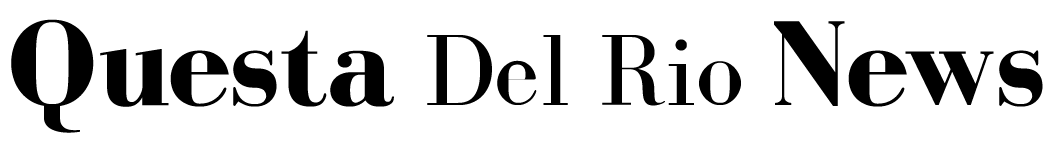

The newly renovated building where the QCU stands was completed in 2017 and as operations expanded, a loan office building was acquired, just a short walk south of the QCU. The main office provides a welcoming atmosphere where you are immediately greeted by one of the tellers. You will also find Flory always present and available there, as well as Garcia, who started in 2011. Behind the tellers is a beautiful mural painting of a money tree, painted by Flory’s daughter, Devonna, complete with foreign coins provided by members

“Our members matter so much to us. Our growth has increased every year and we are meeting milestone after milestone. It’s amazing to see how far the QCU has gone over the years,” says Garcia. “As far as loan rates go, we try to do a little better than the market and banks. Right now, the QCU will drop your auto loan’s current rate by 1 percent when you move your loan to us. This could save thousands of dollars for members over the life of the loan,” says Garcia. The QCU also offers loans on used cars, which is something that traditional banks may not offer. “We take the time to meet with people and provide a one-on-one meeting where we talk about your needs. Sometimes the needs of our members are outside the scope of QCU services, but we help anyway. Building a relationship is really what makes it all worthwhile,” says Garcia.

“We are a minority depository institution, which makes our main focus serving minorities and the underserved population of our community. We are also a Community Development Financial Institution (CDFI) which has helped the QCU with grants and funding that enable us to provide services to people who might otherwise be denied at traditional banks,” Flory explains.

The QCU is excited to start offering business loans to businesses within our community through these CDFI grants. “We’re excited to offer loans to our local business and start-ups because a portion of that money comes back to the community. We really want to help local businesses reach the next level,” says Flory.

QCU has branched out over the years to offer checking and savings accounts, auto, home and personal loans, and additional services such as printing, fax, and notaries. Recently the QCU procured a coin machine—a free service for members, or a nominal fee for non-members. An ATM is offered outside the QCU and another one was recently installed outside the Candy Crate in Red River.

The QCU prides itself on its minimal to no-fee services for members. “We offer free checking accounts for those under 18 and senior citizens, and you can expect to connect with a real person when you call for services,” says Garcia. “Many people pay for fees they don’t need. The QCU doesn’t charge members for a negative balance or ATM fees, offers free business checking accounts, and most members meet parameters that allow for their checking accounts to be free,” says Garcia.

For three years now, the QCU has offered free tax preparation services. The service is for anyone in the community who needs their simple tax returns done. This year, approximately 20 people have stopped in for tax filing. “Community member Timothy Long has volunteered his time at the QCU to help people with their taxes. We are looking for community members, especially students needing community service hours, to contact us and come learn how to help others with their taxes,” says Flory.

Between its mobile app, website, debit cards, copies, printing, fax, notary, IRAs, retirement planning, and share certificates, your financial needs can be met at the QCU. Membership at Questa Credit Union is open to anyone who lives, works, or owns property within the Questa School District, which includes Questa, Cerro, Red River, Costilla, Amalia, and the surrounding areas.

Very soon the QCU will be going through a core change, upgrading to a brand new software that will offer so many more features to members. “This is very exciting for us and members because our new system will make things more streamlined for members,” says Flory. Come August, members will transition to the new platform and the QCU is ready to help with that transition.

The staff at the main office consists of Katherine, teller supervisor Jaime Baños, Tara Hall, Christina Roybal, and part-time tellers Andy Ortega and Alicia Rael. In the loan office along with Patricia you’ll find Irene Martinez, accounts payable, and Michelle Martinez, loan assistant. While traditional banks have come and gone, the QCU has remained. “Our goal is to make sure our members are served,” says Flory. The QCU has been in service for 66 years now and there are no signs of slowing down.

Author

-

Experience working with the USDA Forest Service and extensive knowledge of the northern region, while maintaining and fostering strong community relationships remain a big priority.

View all posts